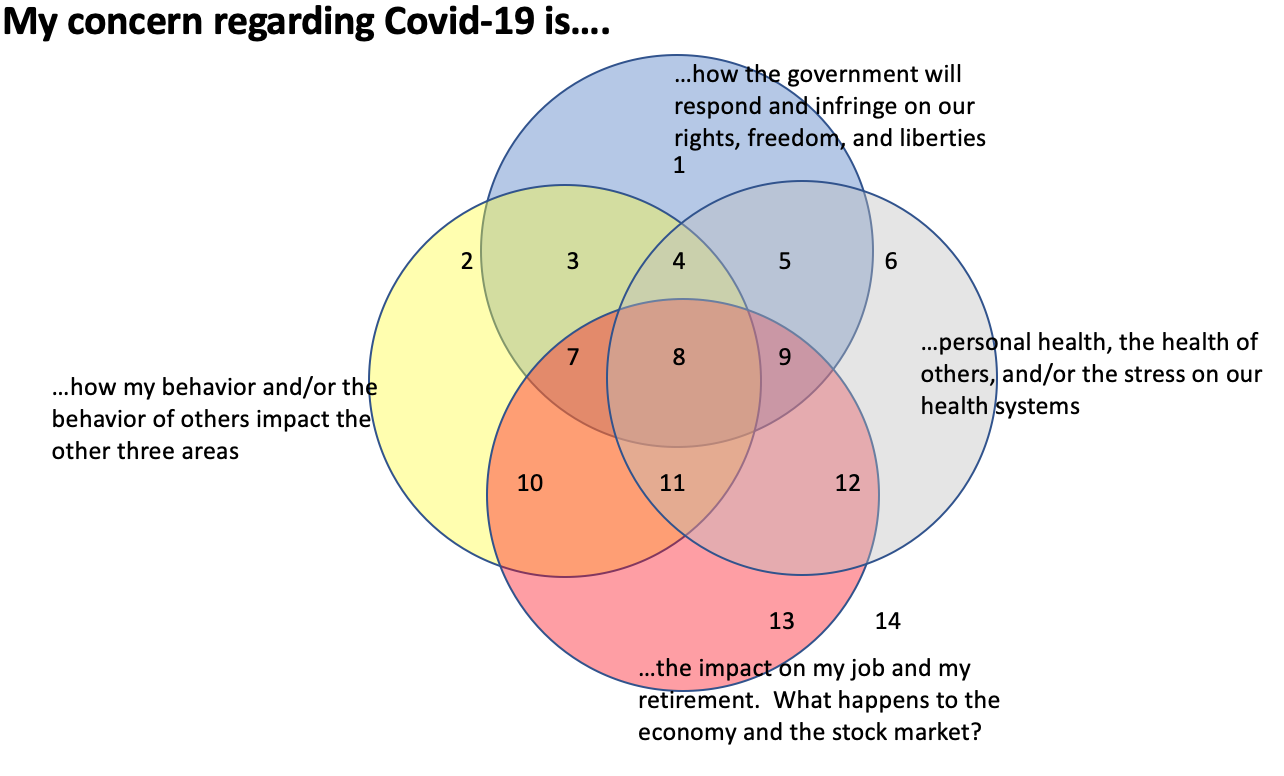

Your routines have been abruptly halted. Your systems have been transformed, and your behaviors and the behaviors of others have a unique, unprecedented, and invisible dependency. The actions and inactions of our government and our neighbors have made you question what is right and what role our government plays in this situation. The flow of information and misinformation doesn’t make this any easier. This directly influences the four components of your unique definition of wealth: Money, Experiences, Relationships, and Time.

We are all sorting through the chaos and trying to give some deliberate thought to how to re-establish routines in an environment where our personal and professional domains have been co-mingled. I need time to organize my kids so I can give them the structure, freedom, cadence, and chemistry needed to succeed. I need time to figure out my day now that I no longer go to the gym at 330 am (i miss my pool). I need time to figure out when I will read, work out, work, be a dad, be a husband, and hopefully not all at the same time. This is our current reality.

The fact that a book has been written called The Ostrich Paradox: Why We Underprepare for Disasters, probably tells us that this was inevitable.

Why is this Hard?

Daniel Kanheman has written in the past about situations that cloud our judgement. The key attributes include:

A Complex Problem

Incomplete and Changing Information

Changing and Competing Decisions

High Stress and High Stakes

Must Interact With Others To Make Decisions

If that one doesn’t connect, maybe this will. Daniel Crosby feels there are four items that prevent us from making good decisions:

See benefits now and costs later

Decision is made infrequently

Feedback is not immediate

Language is unclear

Finally Michael Mauboussin says that the a recipe for stress includes the following:

Lack of control/predictability

Loss of outlets to let off steam

Perceive things are getting worse - contributes to a crisis of confidence

All three psychological artists are painting a different picture of the same environment that we are all experiencing today.

While we need to find ways to simplify, structure, and add routines to our lives. We must also look for clear and collective direction.

Social Distancing is not a Behavior - it is a Characteristic

I find the implicit nature of defining “Social Distancing” creating more problems than it is solving. If I were to ask 10 people what the definition of Social Distancing is, I would get 10 different answers - none of them wrong as we have tried to oversimplify direction and all we have done is added to the complexity. Then we have those that are totally neglecting the concept all together or at least that is the way it is presented - think of all the crowded beach and Disney World pictures you have seen.

Dr. Price is a Pulmonary Doctor in New York City. He has tried to convey what others are failing at. This is what we need to do to protect our family.

Doctors are torn. Their labor of love seems unappreciated as they feel the rest of the country isn’t taking this seriously. They also feel obligated to educate an audience willing to listen. It isn’t the oversimplification of “social distancing”. Here is what Dr. Price asks us to do.

Sanitize your hands after all transactions - the elevator button, the mailbox, the credit card swipe

Don’t touch your face - if wearing a mask creates awareness to prevent it, do that.

Don’t spend time indoors with those outside your immediate family for more than 15 minutes and only if absolutely necessary. Don’t invite others in your house.

Reduce your social circles - we need to avoid co-mingling. We are only as strong as the weakest link. It’s not about if you trust Jimmy. It’s about whether you trust Jimmy’s neighbor’s mom who smokes two packs a day because you think you are “only spending time with Jimmy” but Jimmy is spending time with others and Jimmy is making your social circles - both social and professional, larger and more vulnerable. Conversely, are you making Jimmy’s neighbor’s mom vulnerable from your required professional socialization due to the high amount of asymptomatic carriers? This concept has been called edge carriers.

Those that are doing all they can to isolate are necessarily frustrated and feel their efforts are being marginalized by those that aren’t, but this is what happens when we use an implicit definition. It doesn’t matter if it is “Be Good” to your kids or “Be Compliant” to a Financial Services Company. You have to show the behavior and attributes, not state the characteristic you are aiming for. If you cancelled your daughter’s birthday party three weeks ago, but see the family across the street with 15 people in their house last weekend, your efforts have been cannibalized.

Our Government, Our Economy, and Our People

I think we are all torn on what our government’s role is here. I am struggling with three concepts:

Ben Franklin - “Those who would give up essential Liberty, to purchase a little temporary Safety, deserve neither Liberty nor Safety.”

James Franklin - “If you are not willing to sacrifice for what you want, what you want becomes the sacrifice”

John F Kennedy - “Ask Not What Your Country Can Do for you, ask what you can do for your country.”

We are struggling to understand government’s implicit role with this on top of the implicit concept of social distancing.

Ben Franklin’s quote is the most absolute, but “essential” is the key word. The beach isn’t essential, neither is the NCAA Tournament, or a trip to Disney. What has others concerned is a word that is missing in Franklin’s quote. That word is temporary. You could argue that opening Pandora’s box is a dangerous precedent.

Balancing the medical, government, economic, and civil rights side of this is not easy. The best thing for me is to consider that by giving up my liberties voluntarily now, I am affording others the liberty of a longer life. I am affording myself the right to get those liberties back sooner. I am helping small businesses open sooner. I am not providing the government a weapon to control our lives any more than they already do.

I feel by doing this, I am asking what I can do for my country. I am showing that I am willing to sacrifice for what I want so that what I want doesn’t become the sacrifice. I am giving up non-essential liberty temporarily on my own accord to prevent the government from making that choice for a longer timeframe for me. Unfortunately this is subject to all Americans and all of mankind rowing together as Pope Francis recently offered us in his words.

“We were caught off guard by an unexpected, turbulent storm. We have realized that we are on the same boat, all of us fragile and disoriented, but at the same time important and needed, all of us called to row together, each of us in need of comforting the other”

The absolute lack of leadership is showing. Leadership is not calling for us to row together.

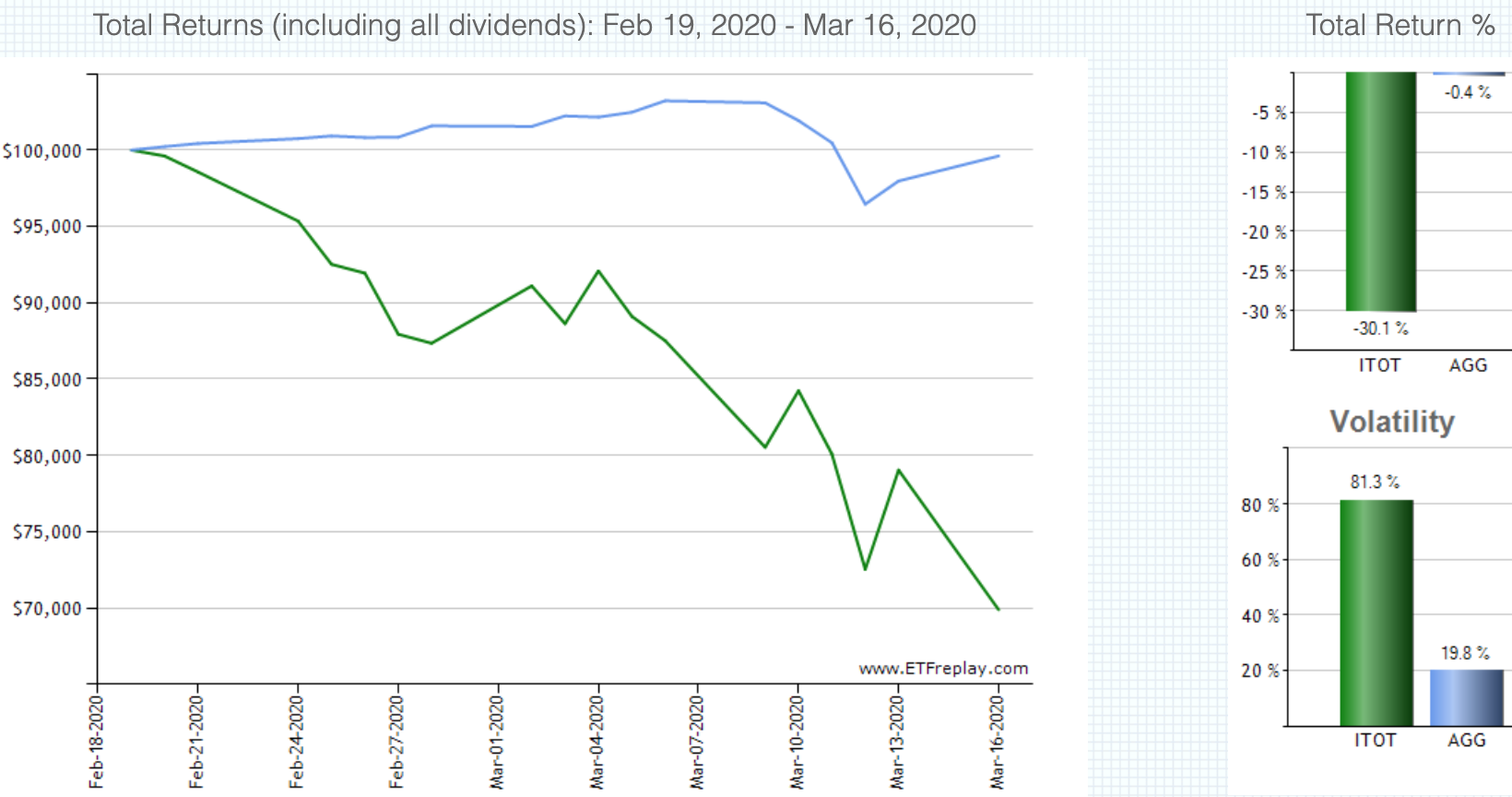

Economically, The New York Federal Reserve published a paper that stated that the sooner that preventative measures are indoctrinated, the better it is for the economy. Their summary states:

"We find that cities that intervened earlier and more aggressively do not perform worse and, if anything, grow faster after the pandemic is over. Our findings thus indicate that NPIs not only lower mortality, they also mitigate the adverse economic consequences of a pandemic."

This drive me to inaction so I can get the economy rolling again. We can argue about how different the world is today than in 1918, but I am willing to give it the benefit of the doubt as the authors did.

Our Collective Mindset

The problem with our mindset I have found is that many feel they are “stuck at home” rather than “safe at home”. Some don’t consider either and they aren’t concerned at all.

"All of humanity's problems stem from man's inability to sit quietly in a room alone" - Blaise Pascal

Another issue is that we “Default to Truth” as Malcolm Gladwell calls it in Talking to Strangers. Default to truth is when we have an operation assumption that the people we are dealing with are being honest. In this case, it is the federal government. Gladwell also discusses the illusion of transparency - where people believe they can make sense of people through their behavior and demeanor. This is compounded by not understanding the importance of the context of which someone is operating. This applies to our government and our neighbors. I may have a 30 year old neighbor who isn’t worried about getting sick and continues with his daily life without self-chosen change. That is his context and it is likely correct. My mindset may be the same, but it also considers others and it considers the economic impact and the impact on our liberties. Neither is wrong, and thus the implicit frustration we are all feeling, but it prevents us from rowing together.

Doubts are not the enemies of belief, they are its companion.

Default to truth becomes an issue when we have to choose between two alternatives - one of which is likely in our minds and one which is impossible to imagine. We start by believing and we stop believing only when our doubts and misgivings rise to the point where we can no longer explain them away.

We have seen these mindsets before with judging others - it’s how Chamberlain viewed Hitler. It was how Penn State judged Sandusky. With few exceptions, we can’t understand how so many missed this. It’s frustrating but you have to do your part and try to help others see things differently, but define the line so that you don’t get frustrated.

From Scott Adams:

If your view of the world is that people use reason for their important decisions, you are setting yourself up for a life of frustration and confusion. You’ll find yourself continually debating people and never winning except in your own mind. Few things are as destructiving and limiting as a worldview that people are mostly rational.

This Extraordinary Time requires Extraordinary (In)Action but that isn’t how Americans think

Ted Anthony offered his analysis in this AP News piece.

Americans prize concrete ideas - that’s why they give Buckeye football players stickers on their helmets; fighting the minute and invisible coronavirus is too small and abstract for our brains. This is compounded by our obsession with outcomes (stickers for voters, kindergartners, and Buckeye football players). On the contrary, this is about establishing and adjusting systems, processes, and behaviors.

We are conditioned to fight and not stand down. Now, the best way to fight is to stand down. “We think if we fight hard enough and use sheer willpower and outmuscle it, then we’ll conquer it. But that can cause us to ignore wise advice from experts,” Van Tongeren says. “If we think of this as an enemy we might have to outsmart instead of outmuscle, then we start to think differently.”

Those are important questions for Americans: How to recognize that outsmarting might work when outmuscling can’t? And how to rebrand the act of, well, not doing things as an expression of resolute commitment to a cause?

The paradigm of 2020 is that to stay at home and not go out, that’s action, but we can’t think that way based on how we have been groomed. Imagining that: an American inaction narrative where staying home is an act of bravery, and when it is multiplied by millions of households, it can literally vanquish the “enemy” at our doorstep.

SUMMARY

We have been groomed for different battles intellectually and psychologically. Now we must adapt.

We all have decisions to make: as individuals, as family units, as a society, and as government leaders. To date, the evidence and the impact of our actions and inactions has just left us frustrated on all fronts.

Understanding the psychological limitations of the framework we have been given, provides us with the insight to understand others contextually, and to begin the process of rowing together.

It helps us understand how this benefits the greater good economically and to reinstall the freedom and liberties we all crave in the long run. This freedom is the “True North” in everyone’s definition of wealth.