Almost every day, I get up before 4am and I go swim somewhere between 2.5 and 3.25 miles - with a monthly goal of swimming 25 days a month and 67.5 miles a month. When I get done, I weigh myself - with the hope of being under 161 pounds and also being at my current weight as consistently as I can.

What is the habit? Getting up at 4? Swimming? Weighing myself? What is the Goal?

You can see the results here.

…and here is my weight on the scale…

My wife thinks I’m crazy, but I would argue that by looking at my numbers daily and seeing what they are telling me, it allows me to be a better investor for my clients.

My process is wake up, swim, weigh, record. This behavior, when coupled with the results, help give me my identity. It makes me more aware of what to eat and that I have the luxury of “cheating” every once in a while, because I have good habits.

I have added to this process a “target” of not eating or drinking alcohol after 600pm. The cost of this system or habit is a little bit of sleep and sore muscles. The benefit is that I can pretty much eat my wife’s amazing cooking without guilt. The process and the measures reinforce my dedication to it because I can see how much it benefits me.

We see this in other places. Delta has a different boarding time than American and Southwest. This longer turnaround time costs them flights and revenue, but it prevents re-work and losses associated with rebooking. It allows them to make up for weather or passengers that have no clue how to board or get off an airplane. Delta overbooks flights by a smaller margin of error to avoid the friction - costs, customer emotions, and a bad reputation. This is their process - they are sacrificing a little bit of “performance”, but they have lower failure costs and fewer failures.

Process vs. Performance

My son loves to pitch. He has great process and habits on the mound and if he doesn’t throw a good pitch or he misses the strike zone 3 times in a row, all I have to say is “Process Check Nathan”. It has gotten to a point that I see where his hands are before he starts his wind up and where his foot lands, and I don’t even have to wait for the umpire to know if it is a ball or strike.

First thing he asks me when the inning is over? Dad, what’s my pitch count? Where are we in the order? How many pitches did I lose? He doesn’t ask about strikeouts or other stats. He knows if his pitch count is low, he has a good process and the results are likely following (with help from his defense).

My weight is feedback on my process. My son’s pitch count is feedback on his process. Likewise, investment performance is one feedback mechanism on my process. My clients shouldn’t want anything different. Otherwise, we are measuring luck.

I look at my client portfolios every day based on the process that I use. I want to know when shifts may be occurring and how I need to respond. Some may say I am crazy, but I don’t look at it through an emotional lens - I look at it through a process lens.

My large cap Offense-Defense holdings are MTUM and USMV, respectively. The triggers and the holdings have “behaved” exactly the way I expect them to. However, there were three days in September that got my attention and then I see a lot of research discussing the valuation and construction of these funds. Do I need to adjust? If my process, my controls, and my action triggers are working as expected, probably not, but I should always be questioning if they do need to be adjusted and if they do, how can I justify the adjustment.

This chart is the process. When the read line is above the black line, i own MTUM. When it is below, I own USMV.

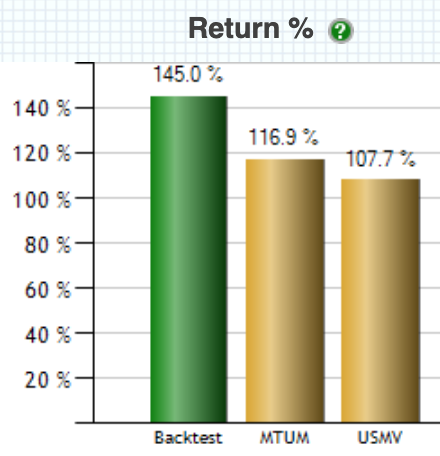

The bar graph below is the outcome. “Backtest” shows what happens when I switch from my action triggers in my process above over if I just stayed in either of the two choices (shown next to back test). I follow this process for all holdings in my accounts. This just allows you to understand the process. These results over this timeframe look good. They don’t always work out this well.

When a batter has figured out my son’s process on the mound, or an umpire has a strange strike zone, he has to adjust - change the pitches he used, shift the infield. Whatever it takes.

Investment monitoring and weighing myself isn’t about the outcome, it is about how my process did. Layovers aren’t about turning airplanes as fast as possible, it’s about the delivery of the highest probabilistic number of passengers. Pitch Count is about command, not the score. The next time you do some form of measurement as a habit, think of it as feedback on your process and not just an outcome.

Investing Processes are about command of your financial plan with your portfolio. It’s about if you have good discipline and hygiene in your financial practices. It’s not about capturing every basis point, it’s about not having to “rebook” your plan or required risk because you were trying to turn around the proverbial airplane in the name of greed or worry more about your strikeouts than your pitch count. When your advisor discusses automating contributions to your account, he is attempting to improve your process and your command over your financial plan.

Swimming, pitching, flying, investing - when your measures focus on the process, you look to improve the process. When your measures focus on the outcomes, you introduce emotions that are unhealthy to your identity, behaviors, and habits. As long as I measure my swimming and investing through an unemotional process lens, it should serve me and my clients well.